4:55 AM: This is Cory Bratland with your Al Kluis report opening grain comments for Friday November 17, 2017. Sluggish exports and the end of harvest pressure were too much for grain prices on Thursday. Lately it seems we start out the night session steady to higher, but during the day trade we get enough commercial selling to push the market lower. In the overnight session, corn is up 1 cent, soybeans are up 3 cents and wheat futures are up 2 cents.

To do: We had no new recommendations. Please keep all offers in place. Click here to review our current and updated price targets.

What I think: Corn prices are under a lot of pressure. As harvest wraps up, more producers may resort to taking a CCC loan on their corn for cash flow. That could allow the basis to narrow up over the next 30-60 days.

Global Stock Markets: Stock prices in China are down 0.5%, Japan is up 0.2% and European stocks are down 0.2%.

Outside markets: The US Dollar Index is down 0.24 points at 93.66, crude oil is up 68 cents at $55.85, S&P futures are down 4 points at 2,580 and gold is up $5 at $1,283 per ounce.

Livestock futures: Closed lower on Thursday. December hogs were down $1.02 at $60.10. December cattle were down 65 cents at $119.55.

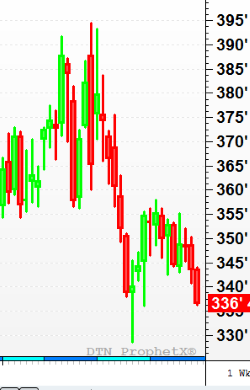

Today’s chart: Corn

About this chart: This is the weekly corn continuation chart. Nearby corn futures sold off 66 cents from the high of $3.94 ½ to the low at $3.28 ½ at the end of August. Nearby corn then proceeded to rally back but found a lot of resistance in and around the $3.54 level (the 38% retracement from the 66 cent selloff). Now we are doing more damage to the chart action by taking out last week’s low. Support now comes in at $3.36. If that doesn’t hold, then we could slip back down to the $3.28 area.

Overnight markets…

December Corn: The trading range is 2 cents; prices are up 1 cent at $3.38. Resistance is at $3.55 with support at $3.36.

January Soybeans: The trading range is 4 cents; prices are up 3 cents at $9.75. Resistance is at $9.81 with support at $9.67.

Wheat: CBOT wheat is up 2 cents, Minneapolis wheat is up 2 cents and KC Wheat futures are up 1 cent.

What to watch: The Commitments of Traders report will be out at 2:00 pm. Will the funds push their corn short position to a record number? The old record short position is 229,000 contracts.